Residential Care Subsidy information

Residential Care Subsidy

We all understand that for the majority of New Zealanders, just keeping yourself and your loved ones fed and cared for to a reasonable level can really add up. It's only natural to worry about how you will cover the cost of long-term residential care in a hospital or rest home in the years to come, if the need arises. For those who simply can't cover the price, it will come as a relief to hear of the Residential Care Subsidy from Te Whatu Ora - Health New Zealand. This subsidy helps with the cost of care, and is paid directly to the hospital or rest home by Te Whatu Ora.

Who is eligible?

You will need to be fall into one of the below categories to be able to get the subsidy:

- If you are aged either 65 or older, OR 50 - 64 and single with no dependent children

- Are assessed as needing long-term residential care in a hospital or rest home

- Need the care for an indefinite length of time

- Are receiving contracted care services.

It could also depend on any money or assets you and your partner have, and how much you both earn.

What about asset limits?

If you're 50-64 and single with no dependent children, you'll automatically meet the asset test.

If you're 65 or older, your and your partner's (if you have one) total assets must be $273,628 or less. If you have a partner who's not in long-term residential care, you can choose whether the total value of your combined assets is either:

- $149,845 or less, if you don't want to include the value of your house and car (your house isn't counted as an asset if it's the main place where your partner or dependent child lives)

- $273,628 or less, if you do want to include the value of your house and car.

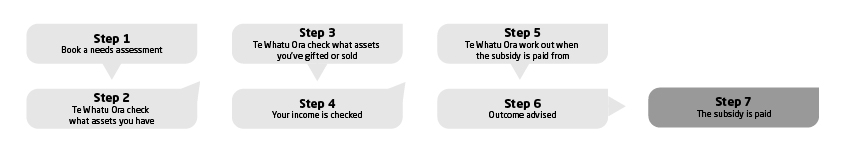

So, what happens next?

Te Whatu Ora will check to make sure your income is below the required limits - this is worked out differently for each type of income. If you don't qualify, you will need to contact Te Whatu Ora for assistance. If you have any questions, contact the Residential Subsidy Unit by:

- calling 0800 999 727

- email msd_rcs@msd.govt.nz

- View their webpage www.workandincome.govt.nz/products/a-z-benefits/residential-care-subsidy.html